ICE Or Electric: Salary Sacrifice Transition To End

HMRC is closing down the transition arrangements for salary sacrifice

HMRC Ends Salary Sacrifice Transition

Salary Sacrifice Calculator

16 February 2021

HMRC Ends Salary Sacrifice Transition Period

If you are in a Salary Sacrifice* arrangement (officially known as Optional Remuneration Arrangements or 'OpRA') and you started the arrangement before 6 April 2017 then you may have benefitted from special rules to keep down your tax bill.

But as the saying goes, 'all good things must come to an end', and so the special transition rules for Salary Sacrifice expire at midnight on 5 April 2021.

What Are The OpRA rules?

In very simple terms, under the OpRA rules an employee who gives up 'cash' pay for a perk (say a company car) is taxed on the higher of the cash given up or the normal taxable benefit of the perk.

For example;

- An employee gives up £5,000pa to get a company car

- The company car would normally have a taxable benefit of £4,000pa

What Are The Transition Rules?

When the OpRA rules were introduced in April 2017 HM Revenue and Customs allowed a transition period of four years to swap everyone to the new tax requirements.

The transition period was needed because the OpRA rules suddenly created higher tax liabilities for some beneficiaries of what were legitimate (for tax purposes) Salary Sacrifice arrangements.

For example, employees with a company car on Salary Sacrifice in 2017 where the employer had taken out a medium/long term lease for the car could have been 'trapped' in the arrangements until the expiry of the lease.

The employer would probably have been unable to cancel the lease without financial penalties, leaving the employee stuck with a company car but with a higher tax liability on the perk.

To ease this, HMRC introduced a four year transition period to allow employees and employers to gradually withdraw from Salary Sacrifice arrangements, for example when legal/financial, etc, agreements came to an end.

But an absolute cut-off date was applied to the transition - arrangements either had to terminate before 6 April 2021 or employees would be switched to the new OpRA rules anyway from 2021/22 tax year.

So What Happens Now?

With the transition period ending on 5 April 2021, anyone benefitting from a lower tax liability under Salary Sacrifice will be swapped to the higher liabilities if OpRA applies on 6 April 2021.

Many beneficiaries of Salary Sacrifice may already be within the OpRA rules now anyway, for example if their company car lease expired before 6 April 2021, as OpRA applies immediately when the Salary Sacrifice arrangements are changed (e.g. on car replacement).

But those whose arrangements have continued unchanged since 6 April 2017 will now find that they are swapped to the higher of the cash forgone under Salary Sacrifice and the 'normal' taxable benefit of the perk.

Is There A Get-out Clause?

Yes, despite the transition period coming to an end, electric or low CO2 company cars provided under a Salary Sacrifice plan qualify for a special exemption.

As a result, Salary Sacrifice for an electric or low emission company car can still be highly attractive and cost/tax effective as a perk for an employee.

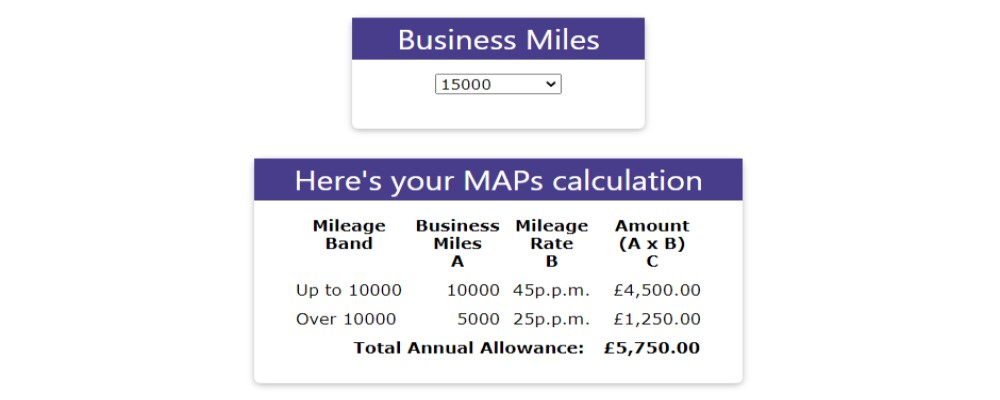

To help you work out whether you or your employer could benefit from an electric company car under Salary Sacrifice, we've produced a free calculator to show the potential savings.

Just click on the button below to try it.

Calculator

*Always consult your professional advisers before acting on tax or other information in our Blogs

Related Tools

Related Posts

What Else Do We Do?

DriveSmart has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

iceorelectric.com

Why not visit our iceorelectric.com website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.