ICE or Electric: Reimbursing Employees For Charging Electric Cars

We explain the PAYE rules for recharging company electric cars

4 November 2020

EV Charging And PAYE

Electric company cars are definitely now 'the new thing'.

With a zero company car benefit until April 2021, and then just 1% for 2021/22 tax year and 2% the year after, an electric company car could save employees significant amounts of tax in comparison with their ICE equivalents.

And employers can benefit too - National Insurance Contributions (NICs) aren't payable on the benefit of an electric company car.

So it's a win-win situation for employers and employees alike.

But there is one downside - you need to get electricity into your electric company car in order to get travel out of it.

Now, paying for that electricity could land you or your employer in hot water with the tax authorities and, as we all know, electricity and water don't mix.

So where's the problem?

Well, the rules for company car benefits and PAYE are only just coming to terms with the electric car age and, as a result, trying to steer through the tax and NIC for an electric car could lead you or your employer straight into a minefield.

The Basics

When money passes from an employer to an employee for business travel expenses, PAYE doesn't usually apply.

Mileage payments, for example, aren't subject to PAYE as long as the payments are only for bona-fide business travel and meet HMRC's strict requirements.

However, add in an element of personal travel and the position is reversed.

Reimbursement of employees' personal travel expenses (and that includes journeys such as home to work) is subject to PAYE.

And where there's an element of doubt over the nature of expenses, for example where reimbursement has a dual purpose, the normal rule of thumb is that PAYE applies and the employee must then justify the business element to HMRC and claim a refund at the end of the tax year.

That sounds straightforward for electric cars. If an employer reimburses employees for charging an electric car for private travel then PAYE still applies.

But it's not always that simple. Let's take two examples:

WORKPLACE CHARGING

Free chargers at work

Let's say your employer provides a free electric car charging point at work

You use the charger to recharge your electric company car and you travel on a mixture of company and personal business without any reimbursement to your employer for the free electricity provided.

Result:

No tax to pay.

Electricty to power electric company cars isn't recognised as a fuel for taxable benefit purposes, so your employer's free electricity to recharge an electric company car escapes tax and NICs.

HOME CHARGING

Using Your Charger

If you have a home charge point (or even just an extension cable), or you use a pavement lamppost charger for your electric company car then, typically, the bill for the power used will be yours.

HMRC has strict rules about employers reimbursing employees for personal liabilities and home electricity is caught by them.

Result:

PAYE applies.

When your employer reimburses you for the cost of electricity then, unless you deduct the cost of charging for private motoring, the reimbursement is liable to PAYE.

Is That It?

Sadly not.

Although it would be hard to describe the colour of electricity, when it comes to PAYE everyone knows there are lots of grey areas.

Let's take the workplace charging issue.

Instead of a free workplace charger your employer allows you to recharge at public charging stations using a subscription card in the employer's name.

That's no problem.

Because your employer has contracted for the electricity charging facility there's still no taxable benefit on any free electricity you get for personal motoring in your electric company car.

But now let's make a subtle change.

You have a subscription for charging with one of the national providers and your employer reimburses you for all the costs of charging your electric company car.

Now PAYE applies.

If you keep a record of business and private mileage then you can claim tax relief in accordance with HMRC's mileage allowances for electric cars, but the subscription reimbursements paid to you must still go through PAYE.

Getting Help

There is help available to follow the correct route and apply PAYE properly to reimbursement of electricity costs for electric company cars

HMRC has provided a user-friendly tool for helping employers and employees work through the complexities of free electricity for electric company cars.

Try the tool - we'll keep your place here while you do.

Related Tools

Related Posts

What Else Do We Do?

DriveSmart has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

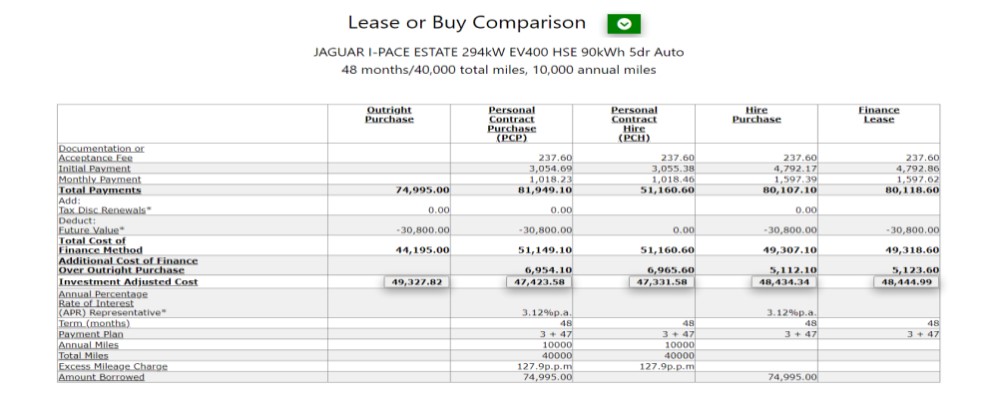

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

iceorelectric.com

Why not visit our iceorelectric.com website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.