ICE Or Electric: How Does Salary Sacrifice Work?

We explain the benefits of salary sacrifice with an electric car

6 January 2021

Could you save money with an EV Salary Sacrifice Plan?

Get an electric company car and your taxable benefit is currently zero for the tax year 2020-21, and the employer's NIC bill is the same - nothing.

Moving forward, electric company cars will be taxed at only nominal amounts in 2021-22 and 2022-23 (at 1% and 2% of list price respectively).

With these advantages the electric company car has definitely come of age in the employee perk market.

But whilst this advantage applies where an employee already has an entitlement to a company car, not everyone gets this much prized perk.

So what about those for whom a company car is a far-away dream?

Well, this is where a Salary Sacrifice plan comes into play.

What Does Salary Sacrifice Do?

Salary Sacrifice allows an employee to trade part of their pay for a perk.

It could simply be a sacrifice of salary (or a bonus or overtime) in return for enhancements to an existing perk (e.g. better medical insurance cover or higher pension contributions).

But Salary Sacrifice can also allow an employee to access an entirely new perk for which they would never normally qualify.

And that's where electric cars and Salary Sacrifice plans come together.

How Does Salary Sacrifice Work With Cars?

We'll get into detailed calculations later, but the principle is straightforward.

Under a typical company car plan the employer provides an employee with a car, maintenance, breakdown recovery and insurance and the car is usually replaced on a fixed cycle according to age and mileage.

So an employee gets a brand new company car every X years and/or Y miles and during that period the car's running costs are covered by the employer (perhaps with free private fuel too).

In a Salary Sacrifice plan the principle is the same - the employer provides the car for a fixed period and mileage and settles the finance costs, etc, but the difference is that the employee then pays back the employer for the running costs.

The employee does this by giving up part of his/her gross (pre-tax) pay each week or month.

And because the salary adjustment is made to gross pay, this can reduce the employee's tax and NIC liabilities (and employer's NIC too).

How Do You Save From A Salary Sacrifice Car Plan?

This is where Salary Sacrifice puts the 'cunning' into 'plan'.

The employer contracts with a supplier for the car, typically on business contract hire.

As a result the cost of the monthly vehicle rental is at corporate rates, usually lower than that of a personal finance contract.

A fixed price maintenance contract is also used, so the employee knows exactly how much servicing, maintenance and repairs ('SMR') will cost. Breakdown recovery is typically included too.

Finally, a company motor insurance plan (or 'fleet policy') provides insurance cover for the car.

The employer has now wrapped up a car in a monthly cost bundle which should be cheaper for employees than if they were to try and put together the a similar bundle.

Now all the employer has to do is allow employees to sacrifice some of their pay to get a car for a lot less per month than they would usually pay.

And The Icing On The Cake Is ...

As electric company cars are not being taxed as a perk until April 2021, and then only at nominal rates for the next two tax years, the employee typically saves income tax and NIC in comparison to 'cash'.

And the same applies to the employer - there's no employer's NIC liability on an electric company car until April 2021 and even after that it's just nominal amounts.

As a result, both sides benefit from savings in a Salary Sacrifice plan in comparison to 'cash' pay.

The Fly In The Ointment.

In fact there are two flies in the ointment.

The first is a set of tax rules relating to pay arrangements where an employee can choose between a perk or cash. These rules are known as 'OpRA'.

The second relates to complications in the rules for recovering VAT and getting business tax relief on car lease rentals.

We've explained more about each of these issues below.

OpRAHaving the option to choose between a perk and cash is caught by special tax rules known as 'Optional Remuneration Arrangements'.

To save space here we've explained OpRA in another blog page, so if you want to read up then click on the link and we'll save your place here.

The key point for Salary Sacrifice and company cars is that the current OpRA rules have a get-out clause for electric company cars.

Electric company car drivers using a Salary Sacrifice plan still benefit from zero company car benefit until April 2021 and only minimal tax for the subsequent two tax years.

As a result, an employee can Salary Sacrifice cash pay for an electric company car and pay zero tax until April 2021 and minimal tax between then and April 2023.

However (sorry, there had to be a 'however'), if the employee wants a hybrid car or one with an internal combustion engine the tax position under OpRA may not be as good.

OpRA tax problems can arise with cars where the car's CO2 output exceeds 75GP/Km - take a look at our explanation of OpRA to see more about this.

But this still leaves electric company cars and hybrids with lower CO2 outputs as attractive benefits under a Salary Sacrifice plan.

VAT and Tax Relief

An employer can't normally recover all of the VAT incurred on contract hire rentals for company cars - usually only half the VAT paid on the rentals can be recouped by the business.

As a result, an employer will normally need to charge the employee for the 'lost' VAT, typically through a higher monthly/weekly adjustment to the employee's pay.

And there's a further complication if the employer provides a hybrid or ICE company car instead of an electric one.

Not only do hybrids and ICE company cars carry higher tax liabilities for the employee, the employer can't always deduct the whole of the contract hire rentals from business profits taxes.

If the CO2 output of the car exceeds 110GP/Km then only 85% of the lease rental payments are tax deductible. Now this won't affect electric cars (which have a zero CO2 output), but hybrids and ICE company cars with higher CO2 ratings could be hit.

And from April 2021 the CO2 limit drops - it lowers to 50GP/Km, meaning that even more hybrid and ICE cars will be caught by the tax disallowance.

As a result, all leased company cars with higher CO2 outputs will have higher total costs due to the tax disallowance.

But the VAT and tax factors can be included in the calculation for Salary Sacrifice so the employer isn't out of pocket for them.

So, Show Me The Money ....

Despite the limitations we've just explained, providing electric or low CO2 company cars under a Salary Sacrifice plan still gives a cost and tax advantage over cash pay.

Salary Sacrifice for a company car, and an electric company car in particular, can therefore be a highly attractive and cost/tax effective perk for an employee.

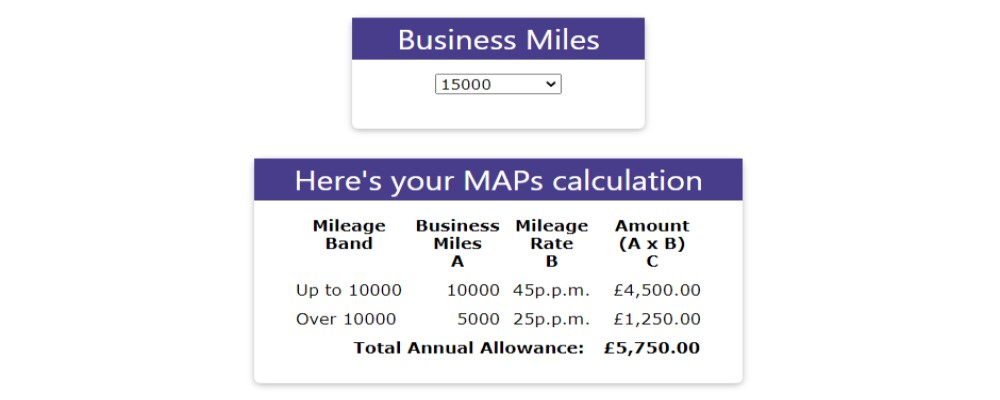

To help you work out whether you or your employer could benefit for an electric car under Salary Sacrifice, we've produced a free calculator to show the potential savings.

Just click on the button below to try it.

Calculator

Related Tools

Related Posts

What Else Do We Do?

DriveSmart has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

iceorelectric.com

Why not visit our iceorelectric.com website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.