ICE or Electric: Electric Company Cars and PAYE

What happens when you swap to an electric company car?

Electric Company Cars And PAYE

18 November 2020

What happens to your PAYE code when you swap to an electric company car?

Get Your PAYE Code Changed For An Electric Company Car

Up to 6 April 2020, if you drive an electric company car you won't have to pay a single penny in tax on the benefit for the 2020-21 tax year.

And from April 2021 you still benefit from reductions in your company car taxable benefit as the Government has already decided the benefit of electric company cars will be:

- 2021-22: 1% of taxable list price*

- 2022-23: 2% of taxable list price*

So if you have made the change to an electric company car, or you're about to do it, how do you get the 0% tax rate?

Don't worry; we explain it all in this blog and and we've provided a sample letter you can send to HMRC to get your 0% tax implemented.

Where Do You Start?

HMRC will only change your PAYE code number when it's notified of your swap to an electric company car either by you or by your employer.

When the switch happens, your employer should either:

- inform HRMC via the Government Gateway internet system; or

- physically send a form P46Car by post to HMRC.

Either way will tell HMRC that your company car has changed and the annual taxable benefit is now zero.

Your PAYE code should then be increased - your old PAYE code reduction for an ICE company car will be removed.

But you don't have to wait for your employer to do this - you can also notify HMRC yourself.

The DIY Route

If you are registered for HMRC services online then you can tell HMRC about the change using the Government Gateway.

Here's the link to HMRC's online contact details if you have a Gateway registration.

Go online and follow the instructions and links for notifying changes to your income but beware - HMRC has made this process extremely complex and convoluted.

An easier route for some may be the online chat facility or HMRC's phone line on:

-

Inside the UK:

0300 200 3300

-

Outside UK:

+44 135 535 9022

But you can of course just write to HMRC about the change.

Simply send a letter to HMRC with details of your new electric company car.

Sample Letter To HMRC

HM Revenue and Customs

BX9 1AS

United Kingdom

(Or use your actual tax office address if you know it)

Date of letter

Your National Insurance Number

Dear Sirs

URGENT - PAYE CODE NUMBER CHANGE

Would you please note that from (date of car change) my company car is now a (make and model of car).

This vehicle is a electric car and qualifies for the 0% taxable benefit.

Previously my company car was a (make and model of previous car).

Would you therefore please:

- adjust my PAYE code number to take account of the reduction in the taxable benefit;

- notify my employer of the new code with immediate effect; and

- confirm the change by sending me a new PAYE coding notice.

Your sincerely

Your full name

Keep An Eye On Your Code

Depending on how close to pay-day you contact HMRC you may not see an immediate change on your payslip, but make sure you do look at your payslip each month afterwards to ensure the change is implemented.

Don't worry if you're not quite ready yet to change to an electric company car.

Just bookmark this page and our sample letter will be waiting for you when the switch to an electric company car happens.

Related Tools

Related Posts

What Else Do We Do?

DriveSmart has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

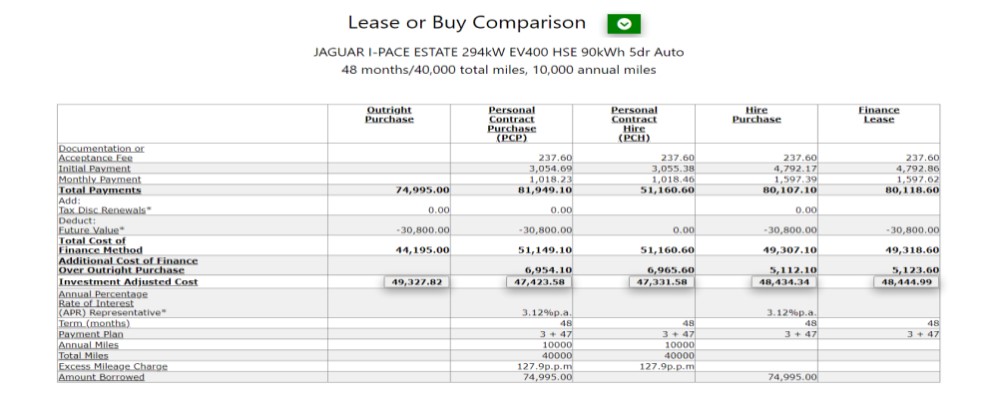

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

iceorelectric.com

Why not visit our iceorelectric.com website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.