The Ice Or Electric Blog: Capital Allowances For Electric Cars

Write off your EV now!

Capital Allowances For Electric Cars

Capital Allowances For Electric Cars

24 September 2020

You'll be relieved when you write off your electric car!

What Are 'Capital Allowances'?

As tax rules go, the ones for getting a deduction for the cost of buying a business car are amongst the most complex.

Instead of just deducting the purchase price of the vehicle against your profits when you buy it, you have the spread the cost over a long, long, time.

Let's say you buy a car for £30,000.

You don't get a £30,000 tax deduction against your profits for the tax year in which you bought the vehicle.

You have to spread the tax deduction across at least your period of ownership of the vehicle (and often longer) through a system called 'Capital Allowances'.

With Capital Allowances, each tax year you get a proportion of the cost of the vehicle as a deduction against profits.

The deduction varies between 6% and 18% of the car's value depending on its CO2 output.

And the rules are written so that the tax deduction you get becomes smaller as each tax year passes.

As a result you can end up waiting for many years to be able to write off a car against your profits, and sometimes you'll still be waiting for tax relief even though you have sold the vehicle and moved on to another.

So How Are EVs Different?

Unlike ICE cars, if you've just bought an electric car for your business you can actually write off the whole cost straight away for tax purposes.

The entire purchase price of the electric car can be set against your profits so, using our example earlier, a £30,000 car will qualify for tax relief in full.

Taking our example one stage further, let's say you made a £30,000 taxable profit this tax year, but you bought a qualifying electric car costing £30,000.

By off-setting your £30,000 EV purchase against the £30,000 profit you've no longer got a tax liability.

(You can even choose to defer the tax deduction if you haven't made enough profits to cover the cost of the car.)

Good News For Hybrids Too

Up to April 2021, if you buy a new hybrid car and it emits less than 50g/km of CO2 then you can write off the cost in the same way as a full EV - there's a 100% deduction available.

Here's The Detail ...

Cars with CO2 emissions less than 50GP/km

Up to April 2021: For company cars emitting less than 50GP/km of CO2 (tax year 2020/21), the full amount of the purchase price can be claimed as a capital allowance in the year of purchase (known as a 'first year allowance'), subject to adjustment if profits are less than the first year allowance available.From April 2021: The CO2 upper limit for first year capital allowances will be reduced from 50GP/km to zero GP/Km, so in effect only electric vehicles will qualify for 100% first year capital allowances, hybrids won't qualify.

Cars with CO2 emissions 51-110GP/km

Up to April 2021: The capital allowances rate is 18% per annum for cars emitting 51-110GP/Km.Such cars are treated as part of the general plant and machinery assets of the business and added to the overall capital allowances pool.

From April 2021: The 110GP/Km limit and will be reduced to 50GP/Km, so for cars with a CO2 output of 1GP/Km to 50GPK/m the capital allowances rate will be 18% from April 2021.

Car Emission More than 110GP/km

Up to April 2021: For cars emitting more than 110GP/km the capital allowances rate is 6% per annum and such vehicles are not added to the general plant and machinery pool.Instead these vehicles go into a separate pool to which the 6% rate applies.

For example:

A car is purchased for £30,000

The existing special capital allowances pool for cars is already at £100,000

The value of the pool becomes £130,000

Capital allowances are given at 6% on the total special pool, i.e. £7,800

The special pool value carried forward to the next year is £130,000 - £7,800 = £122,200

Once again, if the vehicle is sold then the sales proceeds are deducted from the value of the special pool.

From April 2021: The CO2 upper limit of 110GPK/m for the special pool will be reduced to 50GP/Km, so company cars with CO2 emissions above 50GP/Km will go into the special 6% pool, NOT the 18% general pool.

Effects of Capital Allowances

Because cars typically depreciate from new at a rate faster than either of the 18% or 6% capital allowances rates, the practical effect of capital allowances is normally to defer busines tax relief on depreciation for company cars.

This means that, for ICE cars bought outright, tax relief on the total cost of depreciation may not be given until years after the vehicle has been sold.

But with electric cars, relief will be given 100% in the tax year the vehicle is purchased (subject to you having sufficient profits).

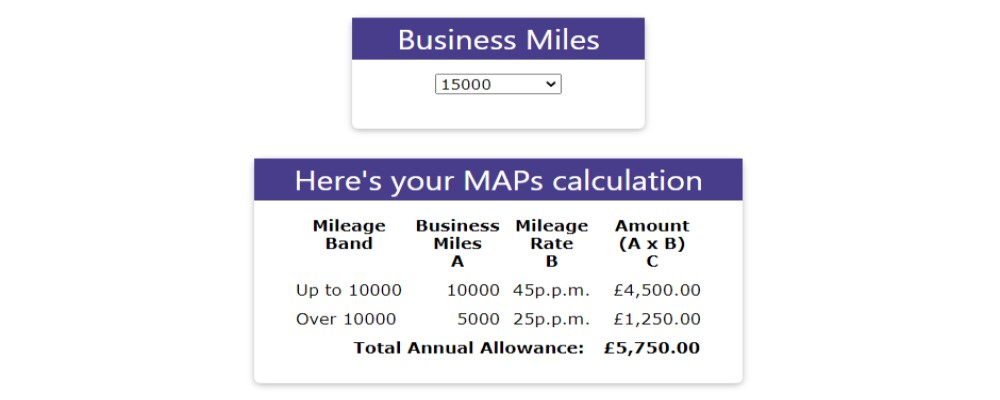

Inter-active Capital Allowances Calculator

To see an inter-active example of a capital allowances calculation just click on this link.

The calculator gives an example of the capital allowances timing for all current new cars using a simple 'non-pooled' basis to demonstrate the extended period of time over which tax relief is given.

Please note: The examples in this page and the calculator relate ONLY to company cars, NOT vans.

For more information on capital allowances for electric vans click on this link.

Self-employed

For the self-employed, where a car bought by the business is used partly for non-business purposes, tax relief is apportioned according to the ratio of annual business miles to total annual miles.

For example:

A qualifying electric car costs £30,000

The car is eligible for capital allowances at the full rate of 100%

The business use of the car is 50%

The capital allowances will be £15,000 (£30,000 x 50%)

Related Tools

Related Posts

What Else Do We Do?

FleetPro has a unique suite of free online tools to help you find the right car.

Take a look at some of our amazing calculators and decision tools for new car buyers.

-

Lease or Buy?

Could you lease a new car for less than the cost of buying? Our lease calculator will work out the best finance method for you. -

ICE or Electric?

Would an electric car be cheaper than petrol or diesel? Our ICE or electric calculator compares running costs instantly. -

Cash or Car?

Could you give up your company car for a cash allowance? Our 'cash or car' calculator will tell you. -

Car Search

Find your next new car by monthly payment, standard equipment, performance, economy and more .... -

fleetpro.co.uk

Why not visit our fleetpro.co.uk website and see for yourself the amazing range of tools and analysis? We'll keep your place here while you browse.